Gusto and Paycom both offer payroll software and HR tools bundled together, but there are also some key differences that make each one a fit for different use cases. In this guide, we’ll compare and contrast the two platforms to help you choose between them.

Gusto vs. Paycom: Comparison table

| Features | Gusto | Paycom |

|---|---|---|

| Starting price per month | $40 fixed rate + $6 per person | Custom quote |

| Our star rating | 4.6 out of 5 | 4.2 out of 5 |

| Automated payroll | Yes | Yes |

| Contractor-only plan | No | Yes |

| Benefits administration | Yes | Yes |

| Time and attendance | Yes | Yes |

| Compensation management | No | Yes |

Featured Partners

Gusto and Paycom: Pricing

Gusto pricing

Gusto’s pricing is quite transparent, and it has multiple plans to choose from, including a contractor-only plan:

- Contractor: $35 per month plus $6 per contractor per month (Gusto will wave the $35 fee for the first six months).

- Simple: $40 per month plus $6 per person per month.

- Plus: $80 per month plus $12 per person per month, with the option to add HR and priority support for $8 per person per month.

- Premium: Custom quote.

- Gusto Global: This new EOR service requires customers to request a custom quote.

If you want to see how Gusto works before committing, you can create an account for free and poke around. You won’t be charged for services until you do your first payroll run, so you have some time to test it out.

Get a one-month free discount on your invoice after you subscribe and run your first payroll with Gusto. Other terms and conditions apply.

To learn more, check out our Gusto review.

Paycom pricing

Paycom offers only custom prices for tailored plans. If you’re interested, you’ll start by requesting a demo. You’ll meet with the sales team to go over how the software works, then you can discuss pricing based on what your business needs.

SEE: The Top Paycom Competitors and Alternatives

However, when looking at user reviews, it looks like Paycom charges around $500 for an initial setup fee for about 15 employees — with an estimated $4 to $6 per employee per paycheck. We can’t verify that this is still the pricing structure, but hopefully it can give you some sense of how much the service will cost.

To learn more, check out our Paycom review.

Looking for a solution midway between Paycom’s robust HCM solution and Gusto’s small-business-focused HR and payroll software? We recommend looking into Paycor instead.

Gusto vs. Paycom: Feature comparison

Payroll processing

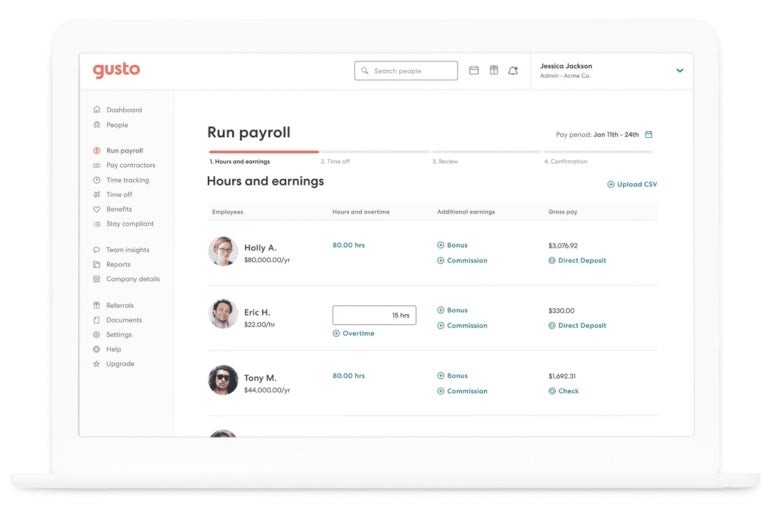

Gusto provides similarly easy and intuitive payroll services so you run payroll without much fuss — and directly deposit your employee’s pay without a lengthy delay. With the Payroll on AutoPilot® feature, you can get even faster direct deposit with one-day turnaround and automated runs. Gusto also has an employee-facing app called Gusto Wallet, which employees can use to review pay information, manage tax elections and access financial tools. And to make things simpler for you, all important payroll documents are stored in one place and tax filings and deductions are automated for easy compliance.

Figure A

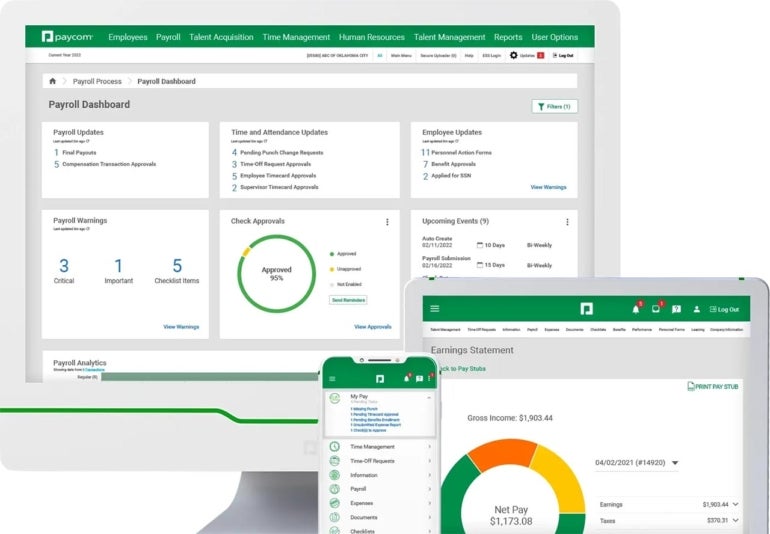

Paycom covers all the payroll essentials: tax filing and withholding, direct deposit, paid holiday tracking and deductions, among others. It also offers payroll cards and an assistant automation tool named Beti, which can help employees with any payroll issues they might run into. With its GL Concierge feature, you can more easily manage your general ledger to ensure everything is accurate and accounted for.

Figure B

Benefits administration

In addition to payroll, Gusto offers benefits administration tools for medical, dental and vision insurance as well as worker’s compensation. Choose from more than 9,000 plans and 30+ carriers, or move your existing health insurance and 401(k) plans into Gusto to centralize everything in one system. You can also get health insurance at no additional cost, and choose from pick-your-cost health reimbursement options. Gusto also provides licensed advisors and compliance support to help you make the right choices for your business.

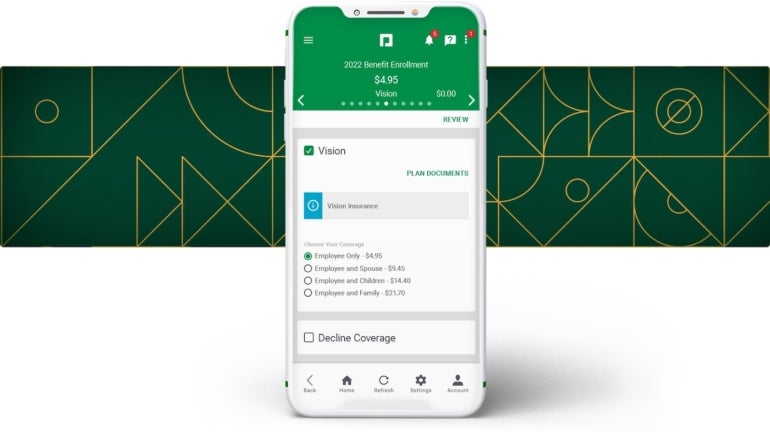

Paycom makes benefits easy with an automated enrollment process, so you can stay on top of things while also remaining compliant. The Benefits to Carrier tool helps you keep track of information from insurance carriers, and with the employee app, workers can enroll for benefits on their phones or on any computer. You can also opt to add a Paycom benefits coordinator to your plan for fully outsourced benefits administration.

SEE: The Top Gusto Alternatives and Competitors

Figure C

HR features

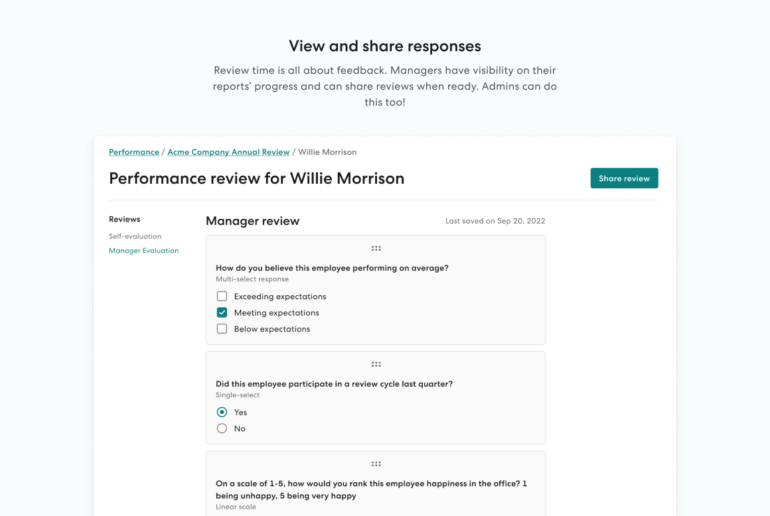

Gusto has numerous HR features for small and midsize businesses — but they are more limited when compared to Paycom. For example, while it does have hiring and onboarding features, performance management, talent management and built-in time and attendance tracking, it doesn’t have compensation management capabilities. Furthermore, you can only get these HR features with the Premium plan, which could be too costly for small or starting businesses.

Figure D

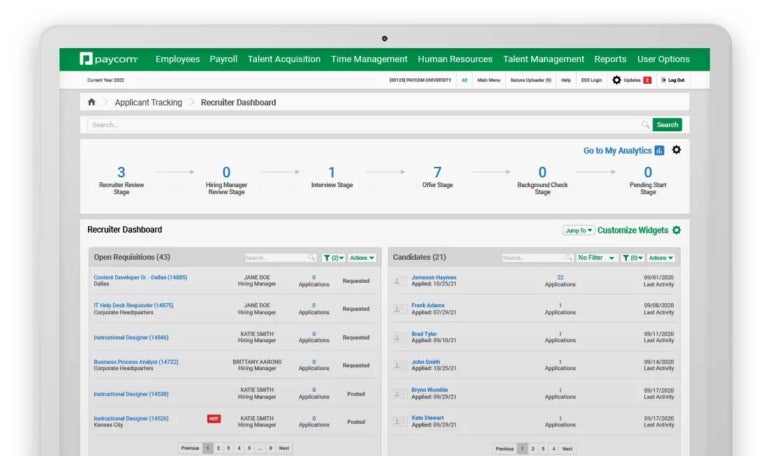

To help you hire the best applicants, Paycom has talent acquisition tools that simplify the recruitment process. It has an e-verification system to check candidate eligibility and run various background checks, so you can get what you need without too much effort. Paycom also offers compensation budgeting, performance management and learning management for after hiring.

Figure E

Gusto pros and cons

Pros of Gusto

- Automated payroll.

- Intuitive platform.

- Option to try out the software for free.

- Transparent pricing.

Cons of Gusto

- Several HR capabilities limited to Premium plan.

- No compensation management feature.

- Clunky Quickbooks integration.

Paycom pros and cons

Pros of Paycom

- Useful mobile app for both iOS and Android.

- Self-service features for employees.

- Compensation management.

Cons of Paycom

- Minimal third-party integrations.

- No free trial and no transparent pricing.

- Costly for smaller businesses.

Methodology

For this comparison, we reviewed Gusto and Paycom’s payroll features, benefits administration and HR tools. We reviewed demo videos, user reviews and product documentation to research ease of use, pricing and user experience — among other details.

Should your organization use Gusto vs. Paycom?

Gusto is definitely the best option for small and midsize businesses due to its transparent pricing plans and the ability to test the software for free. In addition to its intuitive and automated payroll platform, Gusto offers an excellent array of HR features, though not as comprehensive as Paycom’s. Gusto will meet or exceed the needs of many smaller businesses, who will also appreciate the easy-to-navigate interface, but it might not be robust for larger businesses with complex HR demands.

SEE: Best Payroll Software for Your Small Business

Paycom is a better choice for medium and large businesses who need extra features, like compensation management. However, we wish that Paycom’s pricing was more transparent and that it offered a free trial — you’ll have to decide based on the demo alone. If you are deciding between Gusto and Paycom, we recommend getting a pricing quote from Paycom so you can better decide if the cost is worth the extra features.

Top alternatives to Gusto and Paycom

Maybe Gusto and Paycom don’t seem like the right solutions for your business. If that’s the case, take a look at our top payroll software picks for some other options. If you like most aspects of Gusto and Paycom but don’t quite vibe with either one, start by looking into these alternatives.

1 Deel

Run payroll in 100+ countries and 200+ currencies from a single place. Deel’s comprehensive global platform eliminates the ongoing admin of local compliance, taxes, and benefits. With in-house experts across 100+ countries, dedicated CSM’s, visa and PTO support, and more, Deel provides unmatched payroll expertise and service. Plus, with a single point of contact, we eliminate handovers, providing you with faster support and compliance, so your entire global team gets paid quickly and securely.

2 Multiplier Technologies

With Multiplier, pay any number of global employees easily in multiple currencies. Eliminate the hassle of maintaining individual providers per country. Generate a single invoice and pay international teams in minutes. Have a consolidated dashboard to manage global payroll from a single window.

3 QuickBooks

QuickBooks from Intuit is a small business accounting software that allows companies to manage business anywhere, anytime. It presents organizations with a clear view of their profits without manual work and provides smart and user-friendly tools for the business.

4 Rippling

Rippling is the first way for businesses to manage all of their HR, IT, and Finance — payroll, benefits, computers, apps, corporate cards, expenses, and more — in one unified workforce platform. By connecting every business system to one source of truth for employee data, businesses can automate all of the manual work they normally need to do to make employee changes.

5 Paychex

Paychex is a cloud-based payroll management system offering payroll, HR, and benefits management systems for small to large businesses. Paychex covers payroll and taxes, employee 401(k) retirement services, benefits, insurance, HR, accounting, finance and Professional Employer Organization (PEO).