QuickBooks and Xero are two of the best accounting software options with a range of pricing plans to fit multiple budgets. We researched both tools extensively to help you choose the right accounting software for your business. In this article, we compare their core features, pricing and pros and cons to help you decide which one is the right accounting software for your company.

Featured Partners

QuickBooks vs. Xero: Comparison table

| Starting price | ||

| Unlimited billing and invoicing | ||

| Expense tracking | ||

| Mobile receipt capture | ||

| Mileage tracking | ||

| Time tracking | ||

| Inventory management | ||

| Integrations | ||

| Number of users | ||

QuickBooks vs. Xero: Pricing

QuickBooks

QuickBooks Online offers four different pricing tiers to choose from:

- QuickBooks Simple Start: $30 per month with access for one user.

- QuickBooks Essentials: $60 per month with access for up to three users.

- QuickBooks Plus: $90 per month with access for up to five users.

- QuickBooks Advanced: $200 per month with access for up to 25 users.

First-time QuickBooks customers can choose to explore QuickBooks without committing to a plan by signing up for a 30-day free trial. You can also skip the free trial in favor of locking in 50% off for your first three months — but you can’t choose both.

For more information, see our full QuickBooks Online review.

Xero

Xero accounting also offers three different pricing tiers to choose from:

- Xero Early: $15 per month.

- Xero Growing: $42 per month.

- Xero Established: $78 per month.

Unlike QuickBooks, Xero supports unlimited users and organizations for all accounts. It also offers a 30-day free trial so you can test drive the software before committing to a paid plan.

For more information, see our full Xero accounting review as well our list of the top Xero accounting alternatives.

QuickBooks vs. Xero: Feature comparison

Billing, invoicing and payments

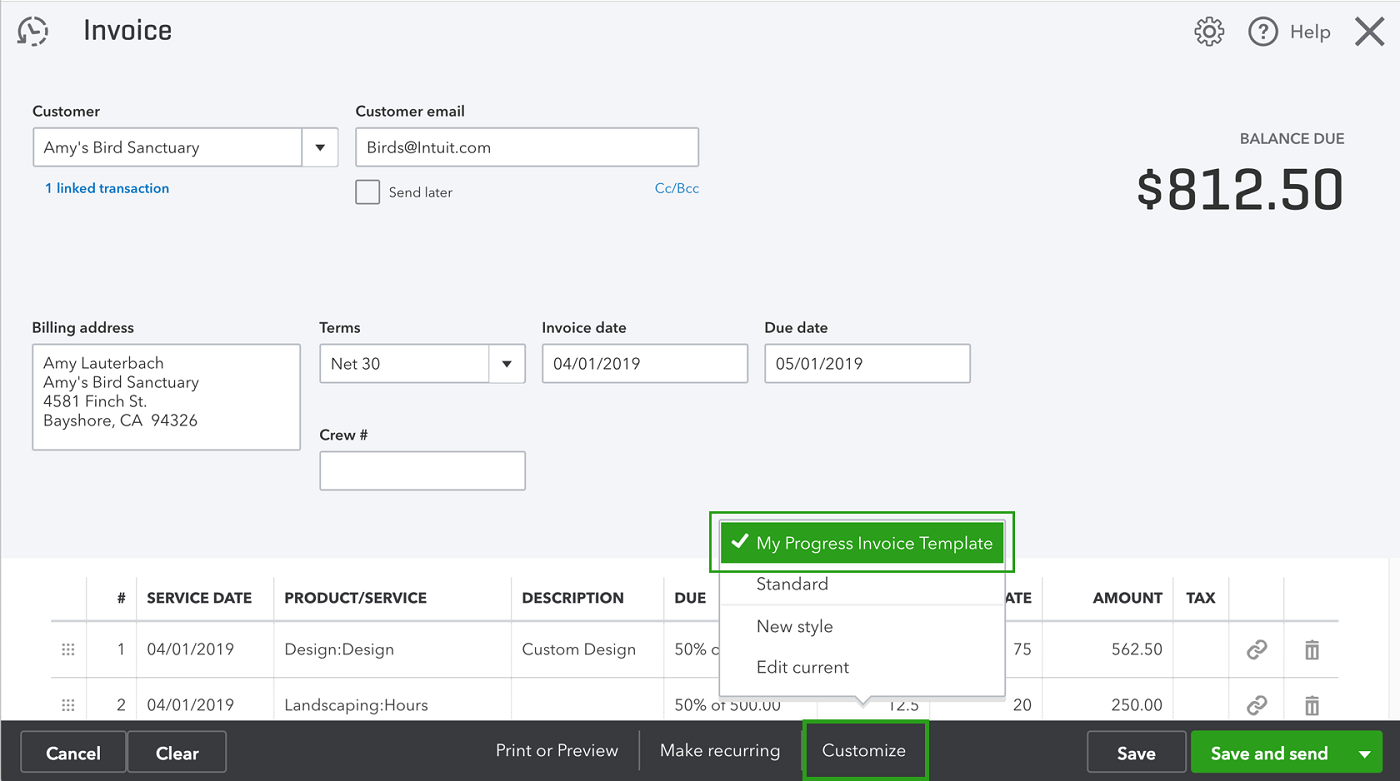

All of the QuickBooks plans allow you to create unlimited invoices and quotes and customize them to reflect your company branding. QuickBooks also allows you to accept payments from debit or credit cards, as well as ACH payments, Apple Pay, PayPal and Venmo. Plus, you can get paid in person thanks to its integration with the GoPayment app and card reader, and you can either enter bills manually or sync your bank accounts to automatically import those transactions.

Xero also allows you to create quotes, send invoices and enter bills, and you can accept online payments by credit card, debit card, direct debit, Apple Pay, Google Pay, Stripe and GoCardless. You can also sync your bank accounts for automatic tracking and reconciliation. However, keep in mind that the entry-level Early plan only supports 20 invoices and five bills per month, so if you regularly exceed that, then you’ll need to upgrade.

Expense and mileage tracking

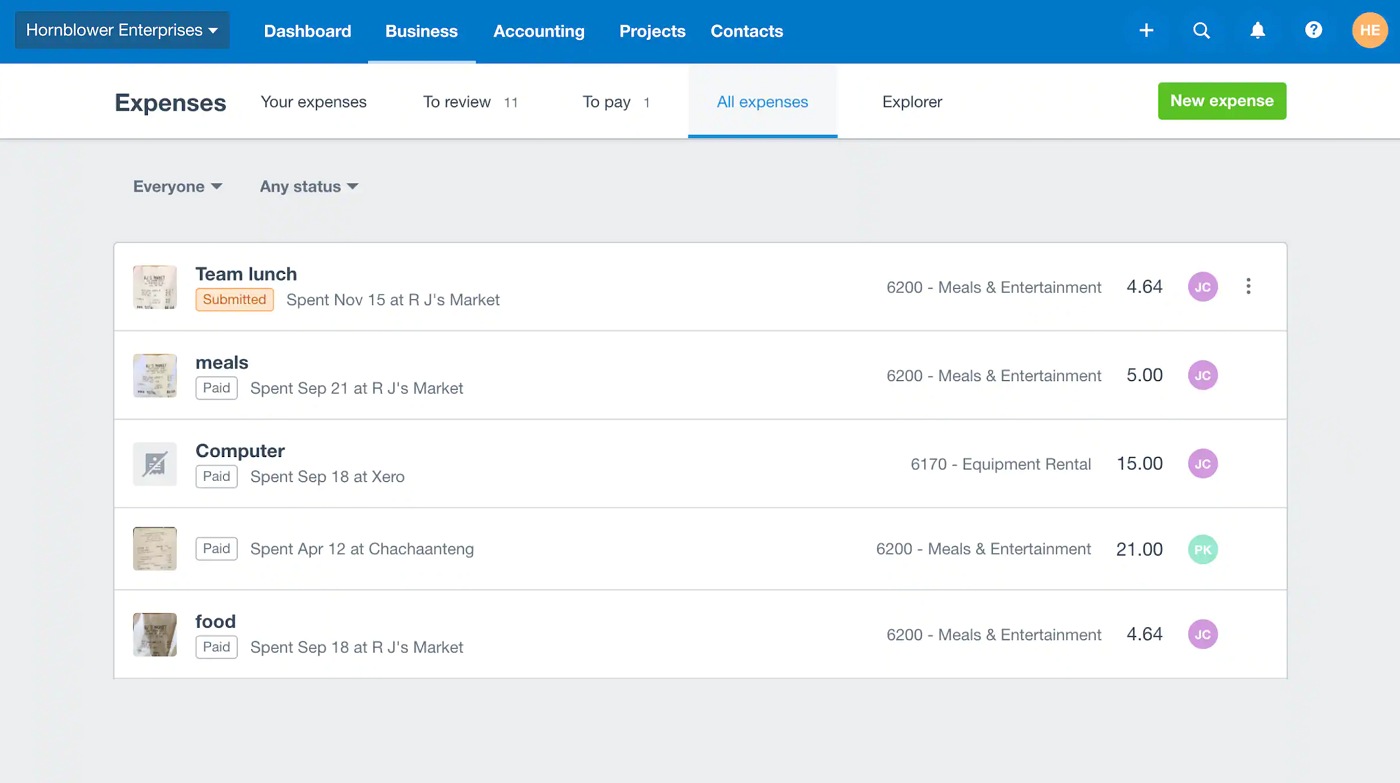

All QuickBooks plans include mobile receipt capture for expense tracking, which is a huge plus — for comparison, many accounting apps include this feature in more expensive paid plans or have it as a separate add-on. QuickBooks can also track your mileage reliably and automatically using a GPS-enabled smartphone app.

Xero also offers mobile receipt capture through its Xero Me mobile app (previously called the Xero Expenses app), though you’ll need to upgrade to the Established plan to claim expenses. The Xero Me app can track and enter mileage from business trips, and Xero offers a built-in integration with HubDoc to extract data from bank statements and financial documents and upload it into Xero.

Project and time tracking

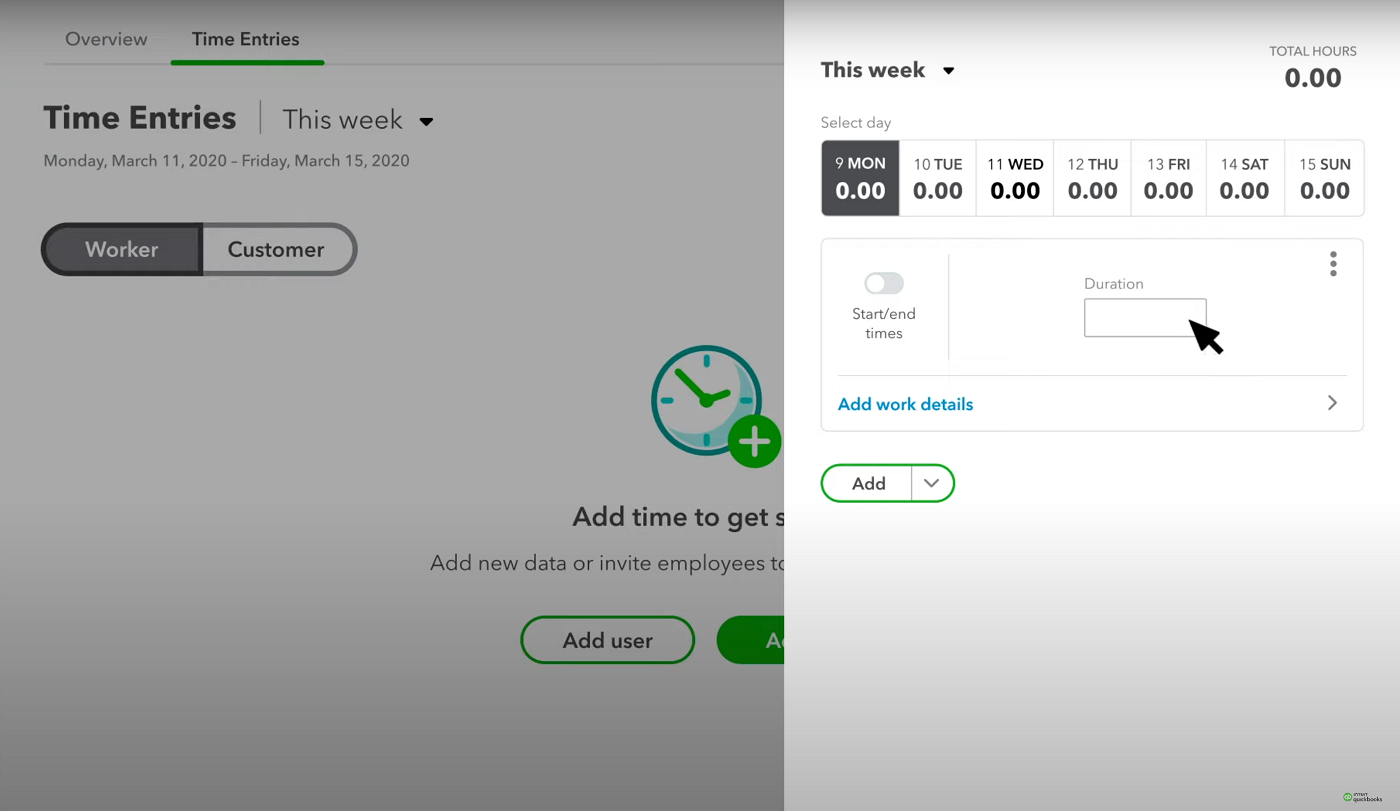

If you upgrade to at least the Essentials plan from QuickBooks, you can enter employee time by client or project and automatically add that time to invoices. For more robust scheduling and PTO management, you’ll need to purchase the separate QuickBooks Time product in addition to the accounting software.

Xero also offers limited time and project tracking. The app has a built-in timer you can use to record time as you work, or you can use the location-based job tracker through the mobile app. Xero also allows you to create a project or job, track time to add to it and add details to invoices when you’re ready to bill clients.

Inventory management

QuickBooks offers excellent inventory tracking features, but you will need to upgrade to the Plus or Advanced plans to take advantage of them. With QuickBooks, you can track products and the cost of goods and receive notifications when inventory gets low and it’s time to restock. QuickBooks analytics make it easy to see what’s selling and what’s not, and you can create purchase orders and manage vendors all in one system. It also syncs with popular platforms, including Amazon, Shopify, Etsy and more.

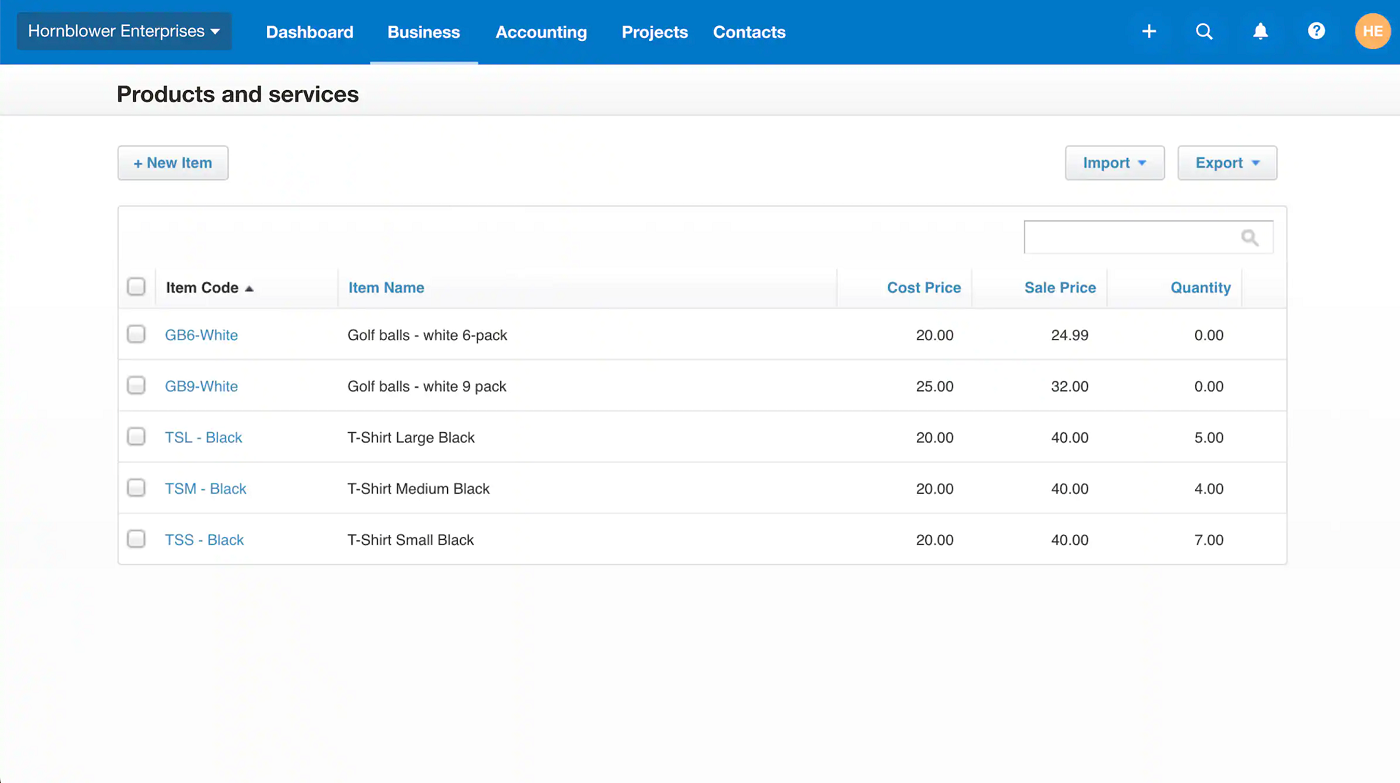

Xero offers simple inventory tracking software that can track up to 4,000 finished items. With Xero, you can view the number of items you have available and see the total value of stock on hand for any item. Its inventory management reports will show you how well different items are performing and which ones are the most profitable. And you can also easily add inventory Items to quotes, invoices and purchase orders to make billing easy.

QuickBooks pros and cons

Pros of QuickBooks

- Unlimited invoices and bills for each plan.

- Familiar to accountants everywhere.

- Advanced accounting features available.

- Multiple pricing plans will scale with your business as it grows.

Cons of QuickBooks

- Customer service could be improved.

- Users limited on each pricing plan.

- More expensive than many accounting alternatives.

Xero pros and cons

Pros of Xero

- Unlimited users on all plans.

- Pricing plans are more affordable.

- Inventory tracking available on all plans.

- Guided setup process available.

Cons of Xero

- Must upgrade to the Established plan to get project tracking and claim expenses.

- Early plan limits the number of bills and invoices you can enter.

- Cannot call customer service directly.

- Could include more options for customization.

Should your organization use QuickBooks or Xero?

Choose QuickBooks if . . .

- You want an accounting software that almost any accountant will be familiar with.

- You need robust accounting software with multiple payment plans that can scale with your business as it grows.

- You have a larger budget that can accommodate QuickBooks’ higher prices.

- You’re okay with having a limited number of users that can access the software.

- You want to be able to call customer support directly instead of waiting for them to call you.

Choose Xero if . . .

- You’re on a budget and looking for a more affordable alternative to QuickBooks.

- You don’t need more advanced accounting features or software that can scale for a very large business.

- You need unlimited users for your accounting software.

- You’re okay with contacting customer support via the online portal and waiting for them to call you if necessary.

- You are willing to upgrade to the Established plan for certain features like expense tracking.

Methodology

To compare QuickBooks vs. Xero accounting, we consulted product documentation and user reviews. We considered features such as invoicing, billing, payments, expense tracking, mileage tracking, project and time tracking and inventory management. We also weighed factors such as pricing, user experience, customer service and integrations.