Square Payroll and Paychex are two small-business payroll software solutions with almost identical starting prices. While they may appear very similar at first glance, once you start investigating them, you’ll realize they’re actually two very different products.

In this Square Payroll vs. Paychex comparison, we put their features head to head to help you decide which one is the best choice for your business.

Featured Partners

Square Payroll vs. Paychex: Comparison table

| Square Payroll | Paychex | |

|---|---|---|

| Starting price | $35/mo. + $6/employee/mo. | $39/mo. + $5/employee/mo. |

| Automatic payroll | Yes | No |

| Automatic tax filing | No | Yes |

| Benefits administration | Limited | Add-on only |

| Time and attendance | Yes | Add-on only |

| HR resource library | Yes | Yes |

| Employee handbook builder | Add-on only | Yes |

| Recruiting and hiring tools | No | Add-on only |

| Performance management | No | Add-on only |

| Learning management | No | Yes |

| Try Square Payroll | Try Paychex |

Square Payroll vs. Paychex: Pricing

Square Payroll

Square Payroll offers two simple pricing plans:

- Full-service payroll: $35 per month plus $6 for each person paid per month.

- Contractor-only payroll: $6 per person paid per month.

While the contractor-only plan is cheaper, it lacks a lot of features the full service payroll plan has, including automatic payroll, off-cycle payments and next-day direct deposit. Other features, such as worker’s compensation and health insurance, are add-ons no matter which plan you choose.

For more information, see our full Square Payroll review.

Paychex

Paychex offers three separate pricing tiers, but only publicly discloses the price for one of them:

- Essentials: $39 a month plus $5 per employee per month. Only available to small businesses with 1–19 employees.

- Select: Contact for a pricing quote.

- Pro: Contact for a pricing quote.

You can add on various features to each plan, such as time and attendance and employee benefits administration, so you don’t necessarily have to upgrade to the next plan if you only need one feature.

For more information, see our full Paychex review.

Square Payroll vs. Paychex: Feature comparison

Payroll

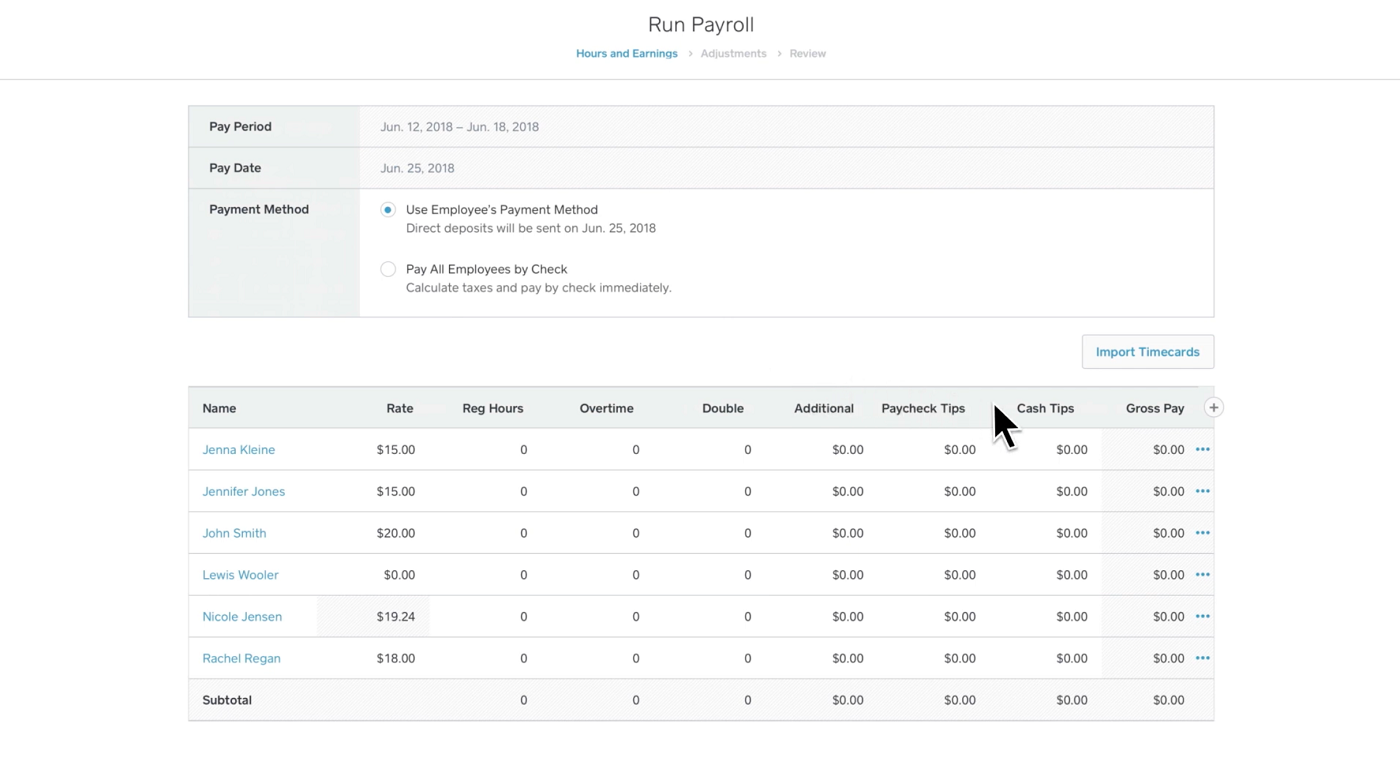

Square’s payroll software does not require a long-term contract or commitment, so you can cancel at any time. Both plans offer unlimited pay runs per month and also allow you to pay your employees by check, direct deposit or Cash app.

If you choose the more expensive full-service payroll plan, you’ll also get access to auto payroll, off-cycle payments, multi-state payroll, multiple pay rates and several options for direct deposit: next day, two day and four day. And you can access everything through both the web portal and the Square mobile app, making it easy to run payroll on the go, wherever your business takes you.

Paychex’s payroll service allows you to pay exempt employees, non-exempt employees and contractors. You can pay employees through direct deposit, pay cards, paper checks, online tip sharing and on-demand access to earned wages. You can also enter and run payroll online or on mobile in as few as two clicks, although Paychex does not offer automatic payroll the way Square does. Paychex also offers the option to submit payroll by phone to a payroll specialist if you prefer a more old-school approach.

Taxes and compliance

Both of Square’s payroll plans include automatic payroll tax calculations and digital delivery of W-2 and 1099 forms. You can also get copies of W-2s and 1099 forms mailed for an annual fee of $3 per form. The full-service payroll plan also comes with automated federal and state tax payments and filings, as well as federal and state compliance alerts. Both plans offer the option to add on worker’s compensation and paid amendment services as well, but those are not included.

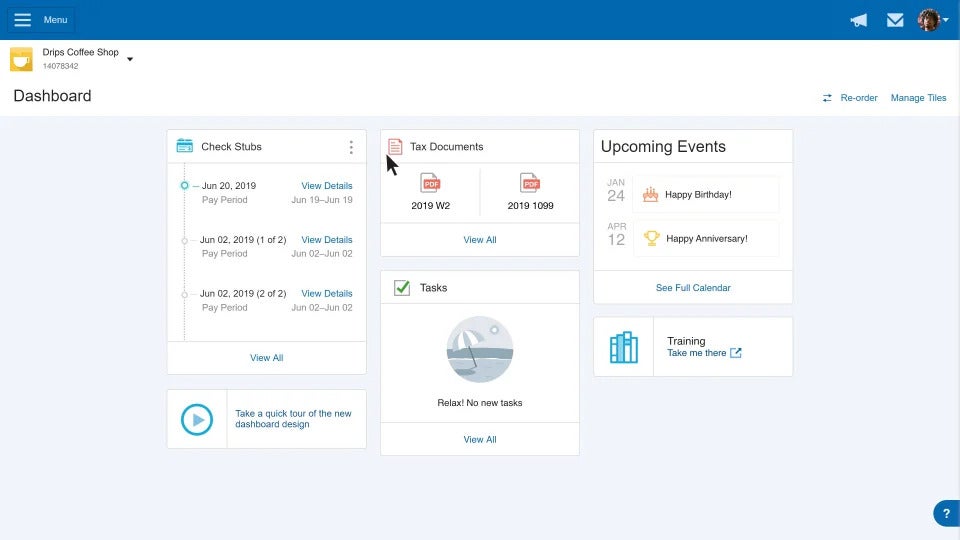

All of Paychex’s plans include access to its Taxpay payroll tax administration, which automatically calculates, files and pays payroll taxes from your account. Paychecks will also generate digital tax documents, such as W-2 and 1099 forms, which can be downloaded as PDFs for printing if necessary.

Paychex also offers additional support for applying for potential tax credits, such as the Employee Retention Tax Credit (ERTC) and the Work Opportunity Tax Credit (WOTC), but you may have to pay extra for this depending on which plan you have.

Benefits

Square offers limited support for benefit administration and deductions. The full-service payroll plan allows you to make benefit deductions, account for company contributions and calculate tax deductions and garnishments. It also includes the option to add-on health insurance and 401(k) retirement benefits, but these are separate fees and not included.

Paychex offers the option to add employee benefit administration to any of its three pricing plans. You can bring your own existing broker or find a new one using Paychex. In addition to offering group health insurance, you can also administer HSA and FSA accounts through Paychex. Plus, it offers thousands of 401(k) investment options to choose from, so you can help your employees save for retirement.

Time and attendance

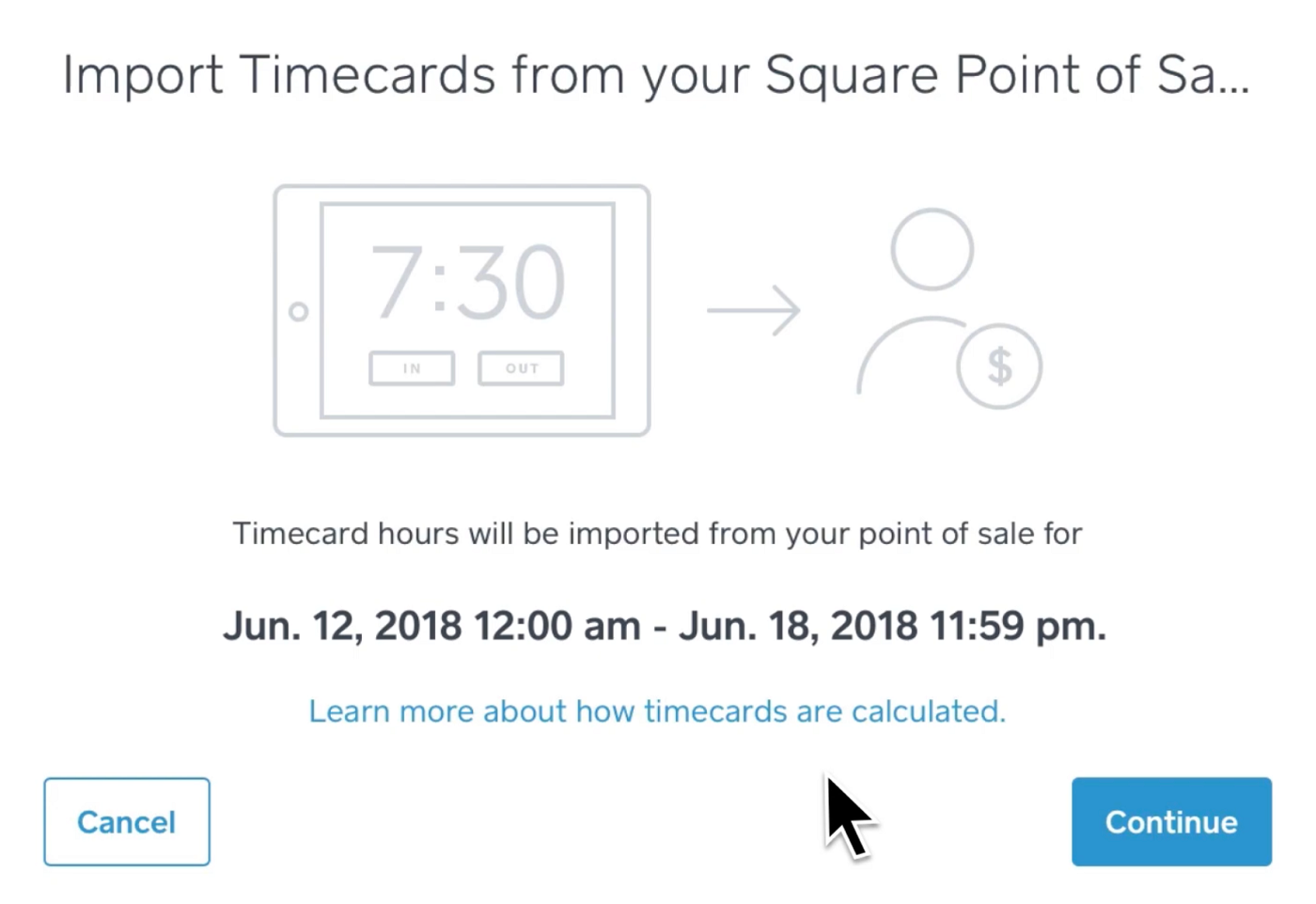

Square makes it easy to import time card information from either the square point-of-sale system or the square team app. The full-service payroll plan also allows you to create team schedules up to 10 days out, track or import direct tips, calculate overtime and generate reports about labor costs. Having your time cards and payroll integrated means you don’t have to deal with annoying imports or manual data calculations.

Paychex’s Flex Time feature is an add-on no matter what base plan you opt for. There are two levels of pricing plans for Flex Time available, but Paychex does not publicly disclose how much each one costs. This cloud-based solution allows you to create a visual schedule, save schedule templates, institute overtime rules, enable geofencing clock-ins, track time off requests, review real time analytics and more.

Other HR features

Square offers a few HR features, but they’re not nearly as comprehensive as those offered by Paychex. The full-service payroll plan includes access to an HR resource library and HR document templates, and with either plan, you can choose to add on direct access to certified HR experts as well as an employee handbook builder. However, if you need more robust HR features than that, you’ll need to seek out different software.

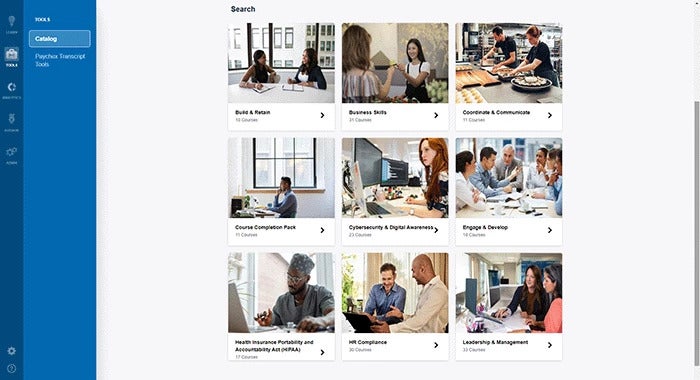

In contrast, Paychex offers far more HR features, though many of these are add-on only, depending on what plan you have, so expect the price to increase if you want access to them all. Some of the options include a learning management system, employee onboarding tools, an HR resource library, an employee handbook builder, pre-employment screenings, job posting website integrations, recruiting and applicant tracking and performance management.

Square Payroll pros and cons

Pros of Square Payroll

- No monthly base free for the contractor-only plan.

- Cancel anytime with no long-term contract required.

- Integrates seamlessly with Square’s point-of-sale system.

- Automatic payroll offered.

Cons of Square Payroll

- HR features are limited.

- Not as many customization options available.

- Benefits administration option not very robust.

Paychex pros and cons

Pros of Paychex

- Lots of tax compliance experience.

- Option to add on many different HR features.

- Many reporting and analytics options.

- Highly customizable payment plans.

Cons of Paychex

- No automation payroll option.

- Pricing could be more transparent.

- Many features are add-on only.

- May not be cost effective for small businesses.

Should your organization use Square Payroll or Paychex?

Choose Square Payroll if . . .

- You already use Square’s point-of-sale system and want seamless integration.

- You don’t need robust HR features.

- You appreciate fully transparent pricing plans.

- You need a simple payroll solution instead of many different customization options.

- You want automatic payroll.

Choose Paychex if . . .

- You need more comprehensive payroll features.

- You want the option to add on many different HR features.

- You don’t need to run payroll automatically.

- You want more benefits administration options.

- You need more reporting features.

Methodology

To compare Square Payroll and Paychex, we consulted product documentation and user reviews. We considered features such as payroll, taxes and compliance, benefits, time and attendance, HR resource libraries and more. We also weighted factors such as pricing, user experience, customer service and transparency.