Tech companies have dozens of critical concerns, from hiring and retaining talent to ensuring products and projects hit their deadlines. Administrative tasks tend to fall on the back burner based on the idea that scarce time and resources should be focused on the core business; expense management software is one way to make financial admin tasks easier.

SEE: Hiring Kit: IT finance manager/budget director (TechRepublic Premium)

The benefits of using expense management software

At growing companies, expense management might consist of a shared spreadsheet and a half-baked approval and reimbursement process. This provides limited oversight; also, unless someone diligently collects and aggregates expenses, your company likely doesn’t have a good handle on which departments are spending what. And, your organization might be awash in recurrent payments for everything from software licenses to office services that are no longer being used or are duplicates. In short, this administrative work will probably lead to limited insight.

What is expense management software?

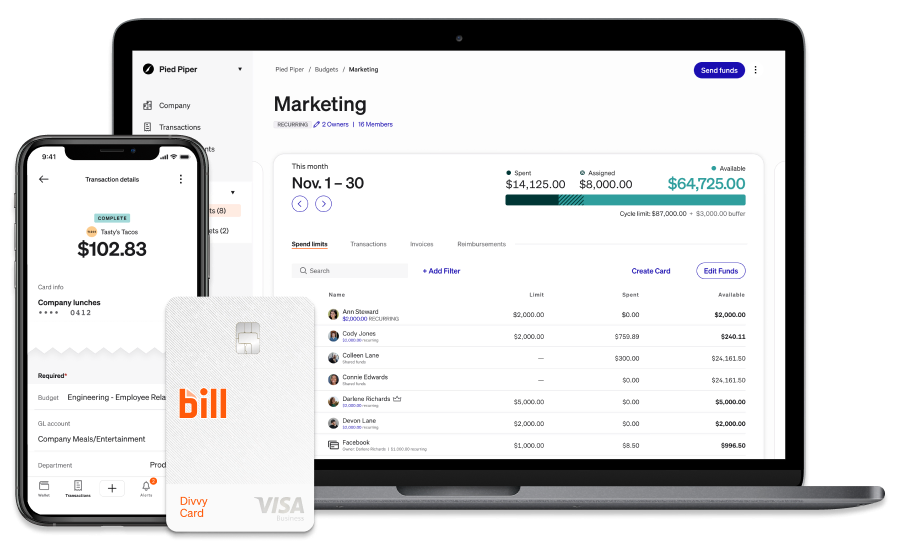

Expense management software addresses these challenges by integrating payment cards, employee tools, and reporting and management in a single platform. These expense management tools were usually the domain of larger companies that could negotiate agreements with credit card companies and purchase expensive software. More recently, companies like BILL Spend & Expense (Figure A) have made expense management tools available to smaller companies; and with BILL Spend & Expense (formerly Divvy), in particular, the tech-forward approach is an excellent fit for growing technology companies.

Figure A

How to use BILL Spend & Expense expense management software

Your company can start using BILL Spend & Expense with a streamlined credit application that allocates credit to the company as a whole, reducing the burden placed on individual employees. Then, your admin can then set up employees and provide them with personal credit limits linked to a company credit card that BILL provides.

Rather than being surprised by excessive spending weeks down the road, every charge appears instantly in BILL Spend & Expense, and charges are declined as soon as an employee exceeds their limit.

BILL’s app makes expense management convenient

In BILL’s mobile app, employees and administrators can view transactions immediately; plus, expense reporting is simplified because employees can individually categorize transactions and capture receipts without any special reports or manual entry. In addition, employees can request increases to their credit limits instantly so that an emergency expense can be approved as soon as possible.

BILL Spend & Expense offers next-level budgeting

BILL has robust budgeting features. Your administrators can create budgets for various items that might range from a marketing campaign to travel for a conference. Budgets can have one or more owners who manage the funds and multiple employees who can receive budget allocations. These allocations appear on the employee’s credit card, and spending on the card can be assigned to the designated budget. As with any other charge, anything above the allocated budget is declined, though individuals can request approvals for exceptions.

A budget view shows all the budgets associated with your company, and a simple graph details the budget amount, what’s been allocated, and what has been spent. Budgets can be either discrete or recur monthly.

BILL Spend & Expense lets users set up disposable credit card numbers

Another BILL feature that’s particularly useful for tech companies is the ability to set up “disposable” card numbers that can be assigned to recurring fees. Most tech companies are awash in software hosting charges, subscription services and other recurring costs; BILL users can create a unique credit card number for these subscriptions, with a monthly cap that cannot be exceeded. These disposable credit card numbers can be quickly canceled if a subscription is no longer being used.

How much does BILL Spend & Expense cost?

BILL’s core tools, payment cards and budgeting capabilities are free to the subscriber, as the company makes its money from the swipe fees associated with credit card transactions. BILL offers additional capabilities ranging from bill payments to rewards.

Save time and be more productive by using BILL Spend & Expense

Expense management might not be at the top of your list of important initiatives, but it’s well worth investigating since it offers the opportunity to free up administrative time that can be applied where it matters most. For time-strapped tech companies with limited budget, perhaps the biggest reward of using such software is the time savings generated from avoiding manual expense reports, delayed reimbursements, and questions about excessive spending that were identified well after the charges occurred.

BILL’s web and mobile-centric approach to these tasks feels modern and accessible and should be more familiar to tech employees than spreadsheets and approval forms.